Managing your Credit Card Debts and Payments - Mainstreet Blog

James Lounsbury | Branch Manager | Goderich

Are you having difficulty keeping up with multiple monthly credit card or loan payments?

Do you have multiple credit card bills or loans to keep track of and pay on different dates?

Does it feel like you’ll never be able to pay off what you owe?

Credit card debt can be expensive to pay down as most cards have high interest rates (10%-20%+) on any balance owing. If you only make the minimum monthly payment on a regular basis you will be paying a large amount of money in borrowing/interest costs and could take a long time to pay off the amount owed. If you have a smaller balance your minimum payment might be as low as $10.00 per month however if your balance is higher your payment is most likely a percentage of the outstanding balance which is generally 3%. Most credit card statements will detail out the number of years it will take you to pay the amount off using just the minimum payment and depending on the amount owed that could be over 20 years and thousands of dollars you’ll pay just in interest on top of what you owe.

Something that can help better manage the debt is a consolidation loan. Simply put, if you combine all your credit card debts into one low-rate loan, you can save a lot of interest and only have to worry about one loan payment vs. paying multiple credit card bills each month.

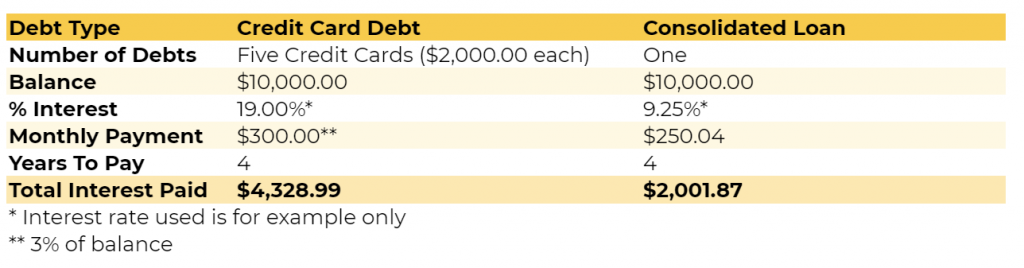

To demonstrate why a consolidation loan may be the ‘right’ choice for you here are two scenarios to think about:

As you can see in the example above with the consolidation option, you save money overall in interest costs + would be paying $50.00 less each month! Mainstreet also offers additional insurance options you can add to loans that provide peace of mind by covering the debt of the loan if you suffer a death, critical illness, or a disability.

Here are a couple of very helpful calculators that can be used to demonstrate how you can benefit:

Mainstreet Credit Union – Loan Calculator (mainstreetcu.ca)

Credit Card Payment Calculator – Canada.ca (fcac-acfc.gc.ca)

Of course our staff can always help by working with you to review your borrowing – whether loans, credit cards, mortgage or more, to ensure you have the best financial plan and lowest rates possible to save you money. Book a meeting with a Mainstreet Financial Advisor to get started today.