The Importance of Investing Early

Investing when you are young can be hard to get excited about. Experiencing the super-fast speeds of the latest tech gadget or buying the wish list items in your cart could arguably provide more satisfaction than putting money away for retirement – a possible 30-plus years down the road.

The fact is, the earlier you start investing, the more time your money has to grow. When time is on your side, it’s a huge ally. You benefit from the power of compounding interest, which is when the returns on your investments begin to pay off. Investment accounts such as Tax-Free Savings Accounts (TFSA) and Registered Retirement Savings Plans (RRSPs) allow for unhindered growth because investment earnings are not taxed as long as the funds remain in the account.

Let’s dig into some of the benefits to consider when you start investing early.

How Compounding Interest Boosts your Investments

Investing early and compounding interest work hand-in-hand. Compounding returns on your investment work like building a snowman – the longer you compound your interest or reinvested dividend payments (or roll your snowball through the snow), the larger your initial investment (or snowball) will get.

Let’s look at an example. Imagine you invest $1,000 and it earns 5% interest annually. After the first year, you will earn $50 of interest on your $1,000 investment, bringing your total to $1,050. Now, in the second year, your new balance of $1,050 will continue to earn 5% interest and at the end of the second year, you will earn $52.50 in interest, bringing your balance to $1,102.50. This process continues and after 10 years, your $1,000 investment has become $1,628.89! As you can see, the longer your investment is compounded, or the earlier you start investing, the greater your snowball/wealth will grow.

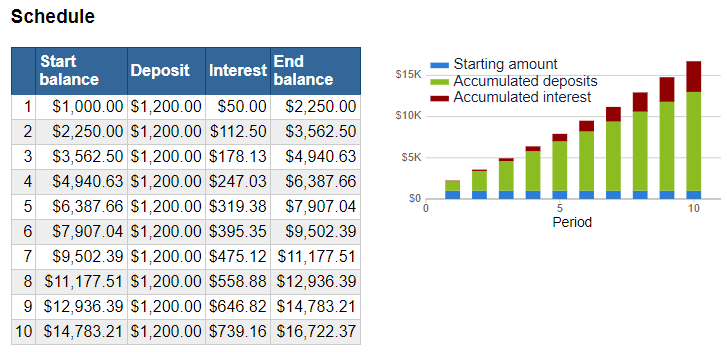

You don’t have to wait until you have a lump sum to invest. The power of compounding is amplified when you periodically and consistently add to your funds to grow your investments. Let’s assume you continued to add $100 a month or $1,200 a year to your initial $1,000 investment above and it earns the same 5% interest annually, after 10 years you would now have $16,722! The graph below demonstrates the year-over-year balance, how much interest you cold be earning due to compound interest. Use our TFSA calculator to understand how much your TFSA could compound.

For Illustrative purposes only.

Now, this is just a simple example of how you can make your money work for you through compounding interest. How and where you place your funds for investment factor into that. To help make that decision, you must consider your risk tolerance. Let’s discuss that next.

Find your Perfect Investment Balance: Understanding Risk Tolerance

Risk tolerance is how comfortable you are with the ups and downs of your investments. If you have a high-risk tolerance, you’re okay with changes in your investment value because you’re focused on the longer term and the higher potential returns of the investment. As an early investor, you tend to have time on your side – especially if you are building your wealth to save for retirement, this may allow you to invest in more growth-focused investments that have fluctuations in value but grow at a higher rate than low-risk investments in the long term.

If you have a low-risk tolerance, you will prefer safer investments that do not fluctuate in value and provide modest returns. This is especially helpful if you need the funds in the short term, for an upcoming purchase that you’ve been saving for. As you near retirement, you will also transition your investments to a lower-risk profile to ensure you have those funds available as you retire.

If you’re unsure of your risk tolerance, our Aviso Wealth and Mainstreet advisors can work with you to find investment options to match your risk level and still allow you to capitalize on compounding, having your money work for you.

Time in the Market vs Timing the Market

As an early investor, it’s tempting to look for instant results. However, staying invested for the long term often outperforms trying to time the market. It can be tough to predict short-term market changes, even for the experts, and trying to do so can lead to costly mistakes. When you stay invested for the long term, your money has the opportunity to grow through compound interest. Historically, markets tend to rise over time, meaning consistent investments are more likely to see bigger returns than jumping in and out based on short-term trends.

The Value of Experience

It can seem overwhelming when you want to start your investing journey, but having a wealth advisor who understands your goals can significantly impact your investment journey when building wealth. An experienced advisor has the skills and knowledge to ensure your investments are placed within the right investment vehicles at the correct risk tolerance, working with you as a trusted partner to help you meet your financial goals.

In times of uncertainty, it can be tempting to sell your investment and hide it under your pillow, especially if you’re not confident in your plan. Similarly, as you mature and encounter new milestones in your life, your needs and goals might change and opportunities might arise. An advisor can put things into perspective talk through scenarios and help you make the most of your investments to keep you on track.

Better Financial Habits

Creating new savings habits may take time, but investing early can make it easier to develop this habit. Paying yourself first by designating a portion of your income into your savings or investment account keeps the money “out of sight and out of mind” and can be made easier with automatic contributions, allowing your savings and investments to grow automatically. This habit lets you steadily work towards your financial goals and build wealth over time.

Good financial habits allow you to find balance while achieving your goals. Starting young, taking advantage of time in the market, and leveraging compounding interest for building a strong financial future will pay off in the long term.

Ready to start building your financial future? Whether you have questions or need guidance, our Mainstreet Wealth Advisors are here to help. Book an appointment online or in person today and take the first step toward growing your wealth with confidence!

Mutual funds and other securities are offered through Aviso Wealth, a division of Aviso Financial Inc. The information contained in this article was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This material is for informational and educational purposes and it is not intended to provide specific advice including, without limitation, investment, financial, tax, or similar matters.